Best Life Insurance For Type 1 Diabetes UK

Can type 1 diabetics get life insurance in the UK – Yes, type 1 diabetics can get life insurance in the UK, but the premiums may be higher due to the increased health risks associated with the condition. However, specialist insurers offer tailored policies for people with type 1 diabetes. When looking for the best life insurance…

Read More

Best Life Insurance For Over 50 UK

What is the best life insurance for over 40s Life insurance is an essential financial product that provides a safety net for your loved ones in the event of your untimely death. If you are over 50, you may wonder what the UK’s best life insurance options are. This blog post will provide an in-depth analysis of…

Read More

What Is The Best Over 50 Life Insurance?

Best life insurance uk over 50 Life insurance may become more pressing as we age, especially if we have dependents who rely on us financially. Several life insurance providers in the UK offer policies specifically designed for people over 50. In this blog post, based on customer reviews and expert ratings, we’ll explore the best…

Read More

What Is Term Life Insurance ?

What is Term Life Insurance and How does it Work ? Life insurance is a contract that pays out a lump sum of money to the beneficiary if the insured person dies. The term life insurance is an insurance policy with a fixed amount of coverage, payable on death. It is important to understand what…

Read More

Who Gets Life Insurance Payout UK

Who Gets Life Insurance Payout- In the UK, the payout from a life insurance policy typically goes to the beneficiaries named in the policy. The policyholder typically chooses these beneficiaries when the policy is taken out, and they can be changed at any time during the policy’s life. The beneficiaries can be individuals, such as family members…

Read More

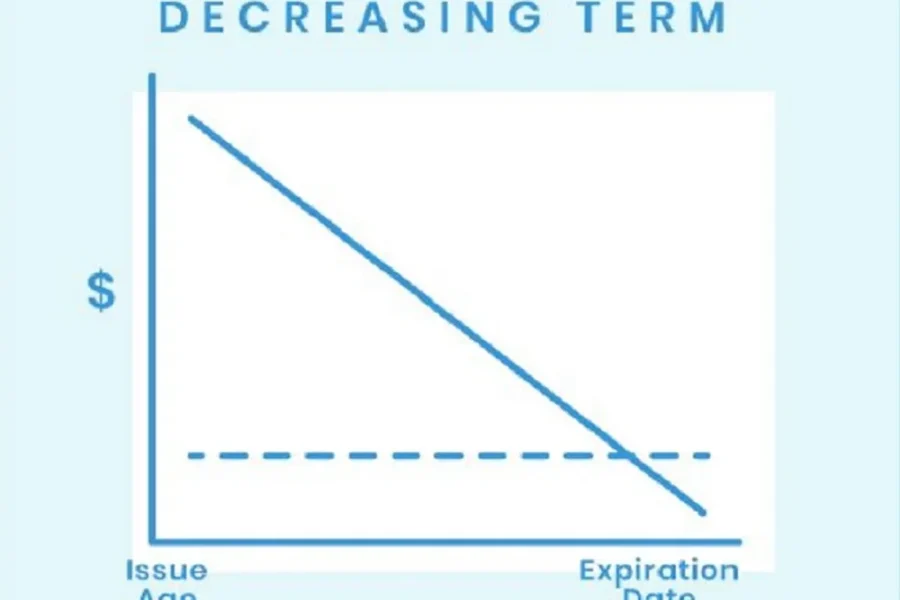

What Is Decreasing Term Life Insurance ?

Is Decreasing Life Insurance Worth It ? Term life insurance is a type of insurance that provides coverage for a fixed period of time, usually for a fixed amount. Term life insurance policies typically offer coverage for 10 years but can be as short as two years or as long as 30 years. It is decreasing in…

Read More

Private Medical Insurance UK Cost

Cost of Private Medical Insurance UK In the UK, private medical insurance is a type of insurance that covers the cost of treatment for illness or injury. It is typically used by people who are not eligible for health care from their employer or by those who want to manage their own healthcare. The cost of private…

Read More

Life Insurance For Under 30 In The UK

Should I get life insurance in my 30s- Life insurance is a significant investment that provides financial protection to your loved ones during your unexpected death. While it’s easy to think that life insurance is something you only need when you’re older, the truth is that it’s just as important when you’re young. Taking out…

Read More

Life Insurance For Over 50s With No Medical UK

Best Over 50 Life Insurance No Medical UK- If you are over 50 and looking for life insurance without any medical examination, several options are available in the UK. These policies are often called “no medical life insurance” policies and are designed to provide coverage without needing a medical exam or any health questions. This blog post…

Read More

How To Calculate Life Insurance Rates UK

Calculating life insurance rates is essential in selecting a policy that meets your needs and fits your budget. Life insurance rates are typically based on several factors, including age, health, lifestyle, and the coverage you need. Here’s a step-by-step guide to help you calculate your life insurance rates in the UK: Determine your coverage needs:…

Read More