Table of Contents

ToggleIs Decreasing Life Insurance Worth It ?

Term life insurance is a type of insurance that provides coverage for a fixed period of time, usually for a fixed amount. Term life insurance policies typically offer coverage for 10 years but can be as short as two years or as long as 30 years.

It is decreasing in popularity because it doesn’t offer the same value as whole life policies. Whole life policies provide coverage over your lifetime and allow you to borrow against the policy to cover any expenses that might occur during your lifetime.

It’s important to understand how term life insurance works and what factors influence the cost.

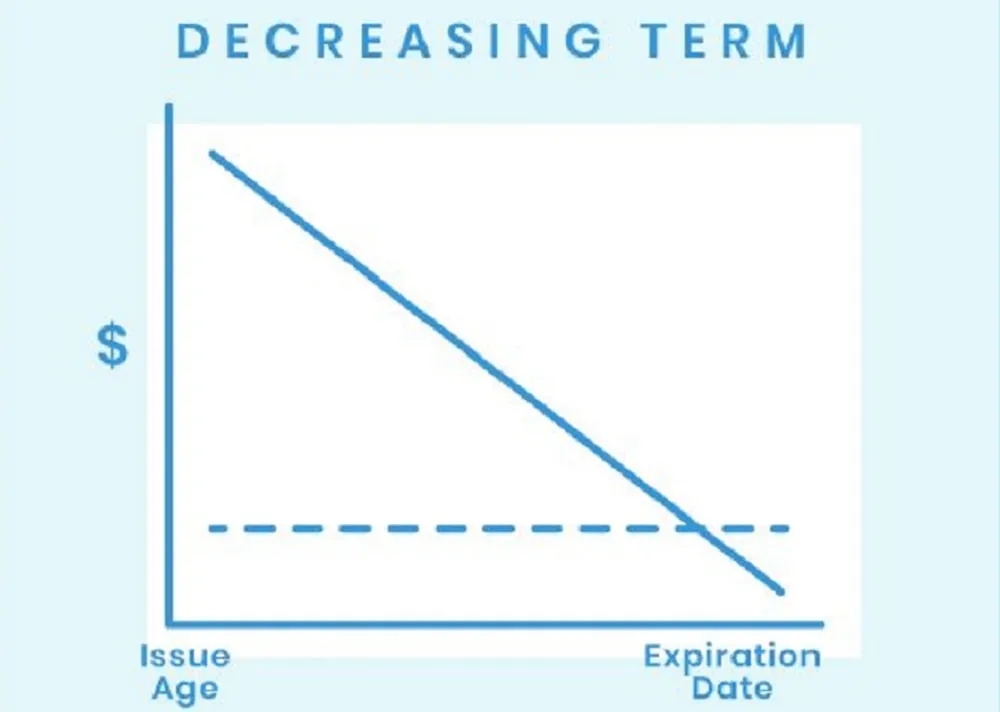

Decreasing term life insurance is a type of term life insurance policy that allows you to pay less for your policy if you wait longer before making a claim. This means you can save money by waiting until your policy expires before making a claim.

What is a Significant Decrease in Term Life Rates?

Term life rates are the amount of money that a person can expect to receive from his or her savings in a given period of time. Term life rates are calculated by multiplying the interest rate with the number of years in a term. A significant decrease in term life rates is when an individual’s savings doesn’t provide as much income as they would have expected. This can happen for many reasons, such as market fluctuations and inflation.

In the UK, term life rates have decreased. This happens to be a significant decrease in the overall life expectancy for UK residents. A recent study by the Office for National Statistics revealed that term life rates have decreased significantly over the past few years. This is a significant decrease in the overall life expectancy for UK residents.

The study found that between 2016 and 2017, term life rates dropped from 5% to 4%. This means that people are now living on average three years less than they were previously living on.

A significant can be attributed to an increase in longevity of people living longer and healthier lives. The study found that people are now living on average five years more than they did previously, which means they’re now living on average 15 years longer than before.

This has led to a significant increase in retirement age because people are able to retire earlier than before due to their longer lives and healthy lifestyles.

Are Term Insurance Rates Rebounding?

This is a question that many people are asking these days. Term insurance rates have been increasing for quite some time and many people are wondering whether they will continue to do so in the future.

Term insurance rates are not rebounding as expected. This is because the market has become more competitive and many insurers have stopped offering term insurance.

A study by the National Association of Insurance Commissioners (NAIC) found that in 2017, there was a 5% increase in the number of people who purchased term life insurance policies, but a 7% decrease in the number of policies sold. The NAIC study also found that premiums increased by 2%, which is less than inflation. They also found that average rates are increasing at just 1%.